features

North America Research: Healthy Growth

As more guests prioritise wellness when they’re travelling, the role of the spa for US hotels is broadening. Mark VanStekelenburg and Jenna Finkelstein of CBRE explain more

We are in the midst of a cycle where hotels are seeing continued growth. According to STR – which tracks supply and demand data for the hotel industry – in 2017, the US national average occupancy was 65.9 per cent, the third consecutive year record high. However, as new supply continues to grow at a rapid pace, ADR growth has slowed. At just 2.2 per cent increase, ADR growth in 2017 was below the long-term average of 3.0 per cent. The question is, where do hotel spas fit within this picture?

Where are the hotel spas?

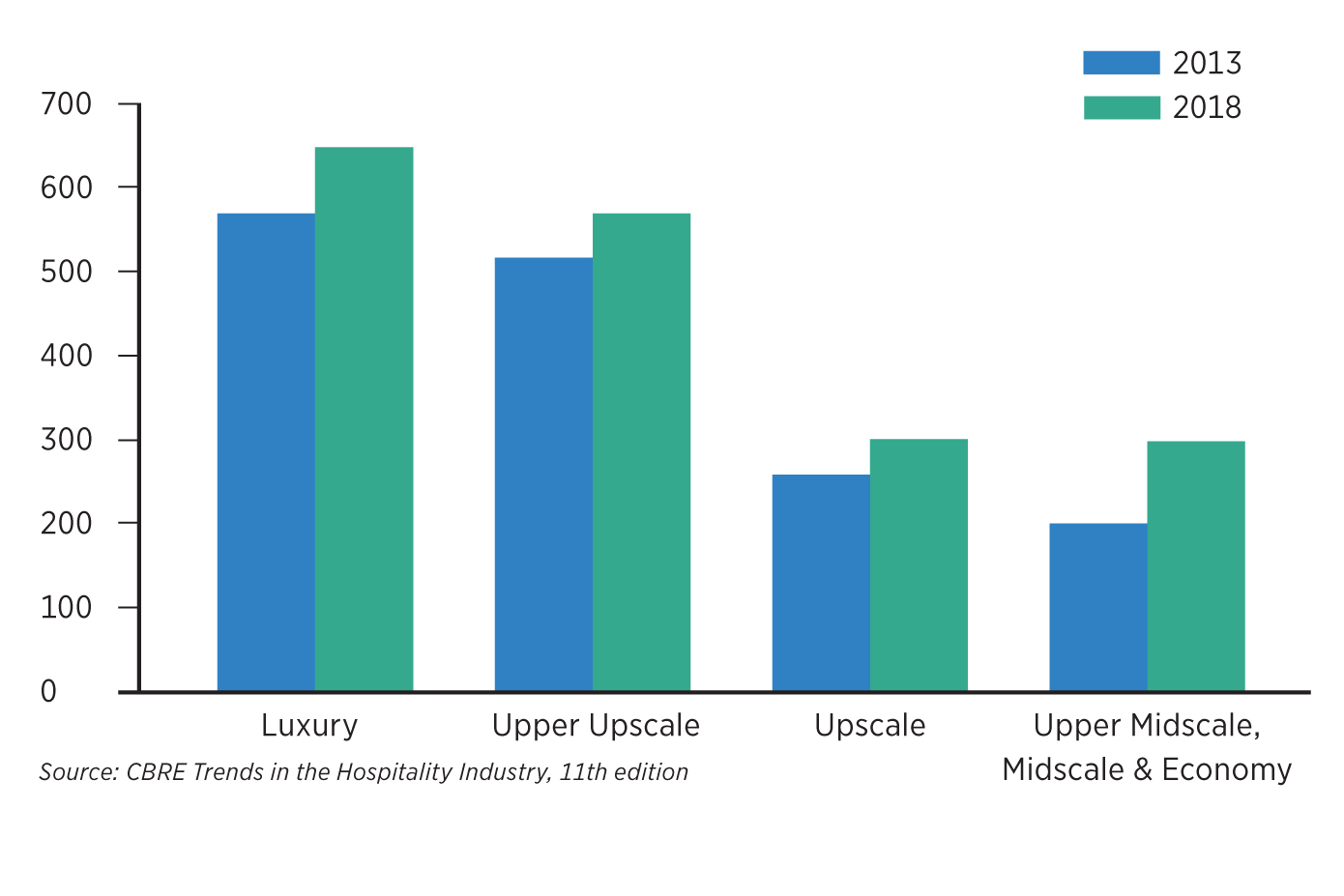

According to STR Census data, just 3.2 per cent of all hotels in the US have spas, at 1,801 properties. When looking at class category, approximately 25.6 per cent of luxury and upper-upscale class hotels have spas, at 42.1 per cent and 17.6 per cent respectively. However, when looking at hotels with spas, more than two-thirds of hotel spas are within these two categories, as shown in Graph 1 below. To see how hotel spas have grown over the years, we looked at the STR Census as of 2013. As of this time, there were 1,520 hotel properties with spas, and 70.1 per cent of these hotels were classified as either luxury or upper-upscale. While the total luxury and upper-upscale segment increased supply by 7.6 per cent between 2013 and 2018, hotels with spas within this category increased by 13.0 per cent, the majority of which was fueled by the luxury segment, at 15.9 per cent. Upper-upscale hotels with spas increased supply by 9.9 per cent over this same time period.

One key takeaway is that an increasing number of lower-tied hotels are offering spas to guests. Hotel spas in the upper-midscale and below segments comprised 12.5 per cent of all hotel spas in 2013; in 2018, they comprised 16.0 per cent. Overall, hotel spas within these three segments (upper-midscale, midscale, and economy) increased by 52.1 per cent.

Topline hotel performance

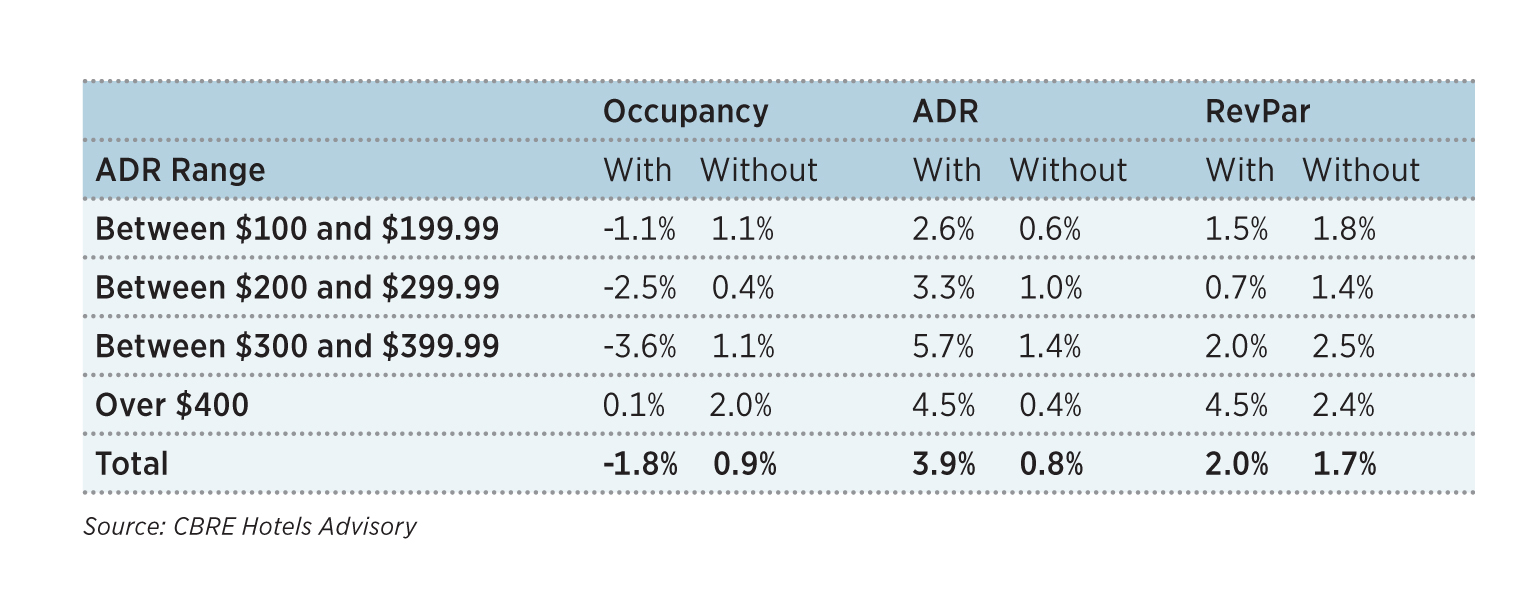

In 2017, the 192-hotel sample of Trends® in the Hotel Spa Industry achieved an average occupancy of 71.1 per cent and an ADR of US$270.03, resulting in a RevPAR of US$192.02. This represents a 1.8 per cent decrease in occupancy, a 3.9 per cent increase in ADR, and a 2.0 per cent increase in RevPAR over prior-year numbers.

We looked at this set’s performance against upper-upscale and luxury properties that do not have spas onsite. This set of 973 hotel properties from the Trends® sample achieved an occupancy of 77.0 percent and an ADR of $199.77, resulting in a RevPAR of $153.78. This represents a 0.9 percent increase in occupancy, a 0.8 percent increase in ADR, and a 1.7 percent increase in RevPAR over prior year numbers.

While the spa trends sample achieved occupancy loss year-over-year, ADR growth was significantly higher than upper-upscale and luxury hotel properties without spas. While growth in RevPAR for the two categories were similar to one another, the spa trends sample achieved RevPAR growth through ADR increases, and hotels without spas achieved RevPAR growth through occupancy increases. It should be noted that RevPAR growth via ADR growth yields a more profitable hotel environment for owners. Further, despite occupancy loss, the spa trends sample achieved average spa department revenue growth of 3.9 per cent. Therefore, even with less heads in beds, hotel spas were able to increase spa revenue through an increase in hotel capture, local guest usage, and treatment pricing.

When looking at performance by ADR range, the story changes slightly. While all hotels with spas achieved greater year-over-year ADR growth than their hotel-without-spa counterparts, only hotel spas with over US$400 in ADR achieved greater RevPAR growth. Hotel spas with over $400 in ADR was also the only category to achieve occupancy growth, albeit slightly at 0.1 per cent.

Hotel spa performance by ADR

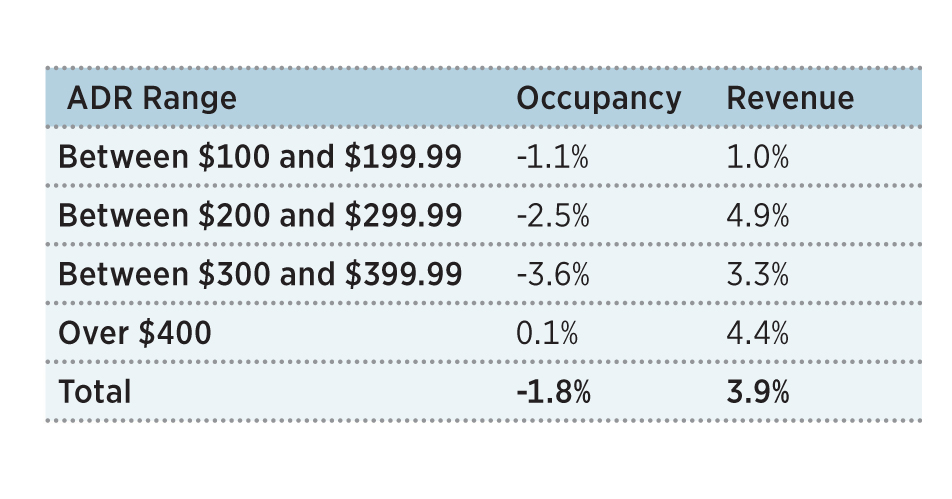

While our Trends® in the Hotel Spa Industry report details spa revenue and expenses by various categories, we analysed hotel spa performance based on hotel ADR to see if there were any key differences across ADR thresholds.

As noted in table 2 above, all hotels achieved growth in average spa revenue, despite overall occupancy declines. Hotels between US$200 and US$299 ADR achieved the highest growth in average spa revenue at 4.9 per cent, while hotels between US$100 and US$199 ADR achieved the lowest growth in average spa revenue at 1.0 per cent. Hotels in this lower ADR category struggle to successfully increase spa pricing. After price increases, a cost of a spa service can sometimes equal the property’s room rate, creating a disconnect in value. Thus hotels in this ADR category heavily rely on increased guest capture in order to increase spa revenues.

Unsurprisingly, spa revenue per occupied room positively correlated with hotel ADR. Hotels with over US$400 in ADR achieved the highest spa revenue per occupied room at US$39.76, while hotels between US$100 and US$199 ADR achieved the lowest spa revenue per occupied room of US$6.52. Hotels between US$200 and US$299 ADR and between US$300 and US$399 ADR achieved the two highest per cent changes, at 7.2 per cent and 7.1 per cent, respectively.

Similarly to spa revenue per occupied room, 2017 spa revenue per treatment also positively correlated with hotel ADR. Hotels over US$400 ADR achieved the highest spa revenue per treatment at US$231.31, while hotels between US$100 and $199 ADR achieved the lowest spa revenue per treatment of US$161.75.

It should be noted the ‘Hotels Over US$400 ADR’ was the only category to see a decrease in spa revenue per treatment over 2016, at 0.9 per cent. This suggests that there is potentially a ceiling when it comes to pricing. Hotels between US$100 and US$199 ADR achieved the highest growth in spa revenue per treatment at 6.8 per cent.

Spa and wellness hotel trends

Hotels have realised the importance of spa during a hotel stay. From the data analysed, guests who stay at hotels with higher ADRs spend more dollars in the spa, and their total expenditures are growing. At the same time, more lower-tiered hotels are introducing spas to their facilities, indicating that guests who pay lower rates also desire spa experiences and are incorporating spa and wellness into their travel routines.

As more guests prioritise their health and wellbeing, hotels will continue to emphasize spa and wellness throughout their operations. In the past, hotels partook in “Artificial Wellness”, in which hotels simply provided a facility. Now, as hotels integrate wellness throughout the entire hotel – from aromatherapy in rooms, to fitness partnerships in expanded fitness centres, to sustainable design – hotel spas are benefitting from the health of the overall hotel.

Wellness within hotels has transitioned from solely spa, an isolated piece of the hotel, to beyond the walls of the spa. As such, hotel spas have become a true sanctuary of health and wellness. While domestic and international travel has grown exponentially over the past years, there are also more hotels and alternative lodging products than ever before, and the supply pipeline does not show signs of slowing down. Therefore, hotels must continue to offer innovative services and unique guest experiences in order to differentiate themselves. Hotels that harmonise spa and wellness into this equation are set up for future success.

Source: CBRE Hotels Advisory

Mark VanStekelenburg, managing director, and Jenna Finkelstein, director, work in the Hotels Advisory department of the CBRE office in New York City. To purchase a copy of the Trends® in the Hotel Spa Industry report please visit https://pip.cbrehotels.com/store, or call (855) 223-1200.