features

Research: Generation gap

ISPA’s latest consumer study shows how spa-goer habits vary across different generations. Research authors Russell Donaldson and Mia Carter share their highlights

Millennials and gen X have the strongest spending power and are more likely to look for a ‘digital detox’, while gen Z are an upcoming market who seek out comfort and visit with friends. These are just a couple of observations from a new consumer study by the International Spa Association (ISPA). Released in June, the study was based on interviews with 1,000 spa-goers across the US (see p76) and highlights behavioural patterns between different age groups – what ISPA refers to as “unmasking the generational shift”. The study is intended as a vital source of information for spas to learn about the habits of their current customers, as well as to get a step ahead of the industry’s next big trend.

So, what does the research have to say about different generations of spa-goers and how is it relevant to the day-to-day offering of spas?

Spending power

Encouragingly for the industry as a whole, consumer spending on treatments and retail in spas is strong. Looking at the data through a generational lens shows that it’s millennials and gen X who are currently the industry’s biggest spenders, with the highest spend on treatments, retail and gift cards compared with other generations. More than half of millennial and gen X spa-goers reported spending US$80+ (€70, £63) on treatments on their most recent visit (56 per cent and 53 per cent respectively), while 72 per cent and 68 per cent said they also purchased a retail product at the spa. Overall, baby boomers and the greatest generation (born before 1946) appear to be the group’s least likely to spend: 43 per cent and 69 per cent respectively made no retail purchase on their most recent visit, by comparison.

The study also explored consumer attitudes to using personal technology such as smartphones in the spa environment – an ever prickly subject. The majority of consumers (89 per cent) feel the balance is right when it comes to how strict or lenient technology policies currently are. However, looking at the nuances between generations reveals that millennials (14 per cent) and gen X (12 per cent) are slightly more likely than the other groups to feel that technology policies are too liberal and do not allow enough privacy.

Moreover, over a third of both millennials (36 per cent) and gen X (34 per cent) feel that a technology ban would make a spa more attractive – considerably higher than gen Z consumers (22 per cent). This could be a sign that these sometimes stressed and overworked millennials and gen X consumers appreciate the opportunity to switch off at a spa in pursuit of a ‘digital detox’ more than younger generations.

Gen Z – a coming force

Just as millennials have become a powerful force in the economy, another younger generation will inevitably follow, and soon purchasing power will shift downwards to the so-called ‘gen Z’ – people born between 1996 and the present day. It will be useful for spas to be aware of what appeals to this coming generation, because in the same way that spas were able to capitalise on the needs of millennials, there will undoubtedly be a sizable opportunity for spas with a strong offering catering to the needs of gen Z.

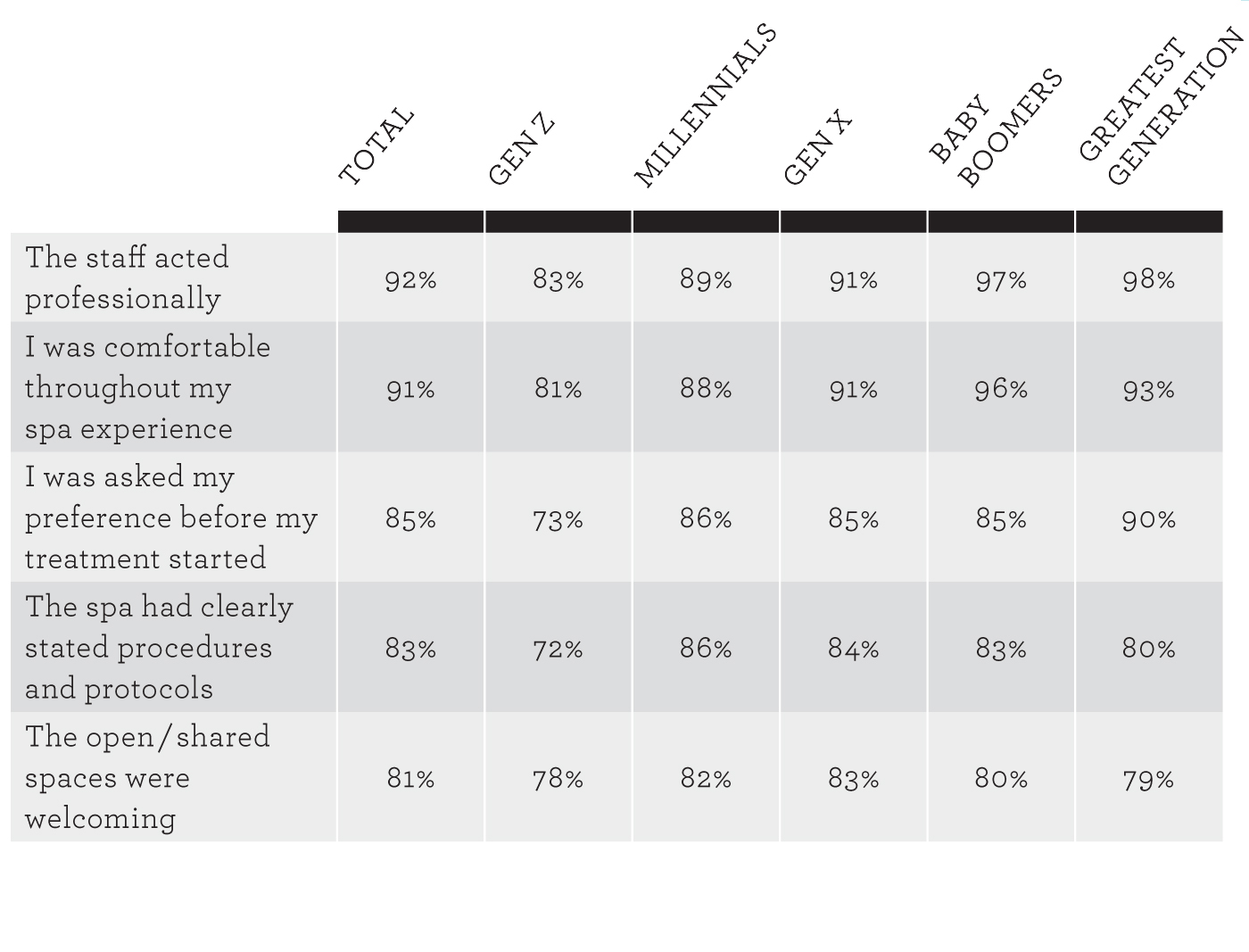

As a place of relaxation, it goes without saying that spa-goers should feel comfortable and welcome when visiting a spa. Table 1 shows that the vast majority of spa-goers interviewed agreed that they felt comfortable during their spa experience (91 per cent) and that staff acted professionally (92 per cent). Most spa-goers noted that they were asked their preferences before their treatment (85 per cent) and were aware that the spa had stated procedures and protocols (83 per cent).

While at an overall level, the numbers show spa-goers to feel very comfortable with their experiences, looking at the figures from a generational perspective demonstrates some interesting differences with gen Z recording consistently lower scores than the other generations. Where the industry has seen millennials progress to join gen X as the bigger-spending consumers in spas, an important question lies in what can be done to continue to make gen Z feel more comfortable and support that young group as the ‘up and coming’ spa-going generation. The role of the service provider can be crucial here, in both being attentive to their needs and ensuring that the end-to-end experience is as comfortable as possible.

How do people visit a spa?

The study shows that more than half of the spa-goers interviewed reported visiting the spa alone (55 per cent) on their most recent visit. Gen Z, however, are the most likely to visit with a group of friends (30 per cent) – this figure then drops moving up different generations through millennials (24 per cent), gen X (17 per cent), baby boomers (12 per cent) and the greatest generation (11 per cent).

These findings suggests that gen Z may find value in the spa to be a shared experience, as a way of connecting with friends. More obviously, they are the generational group most likely to visit the spa with parents or family, providing a good opportunity for spas to make an impression on these young consumers and capture their interest early on.

Booking preferences

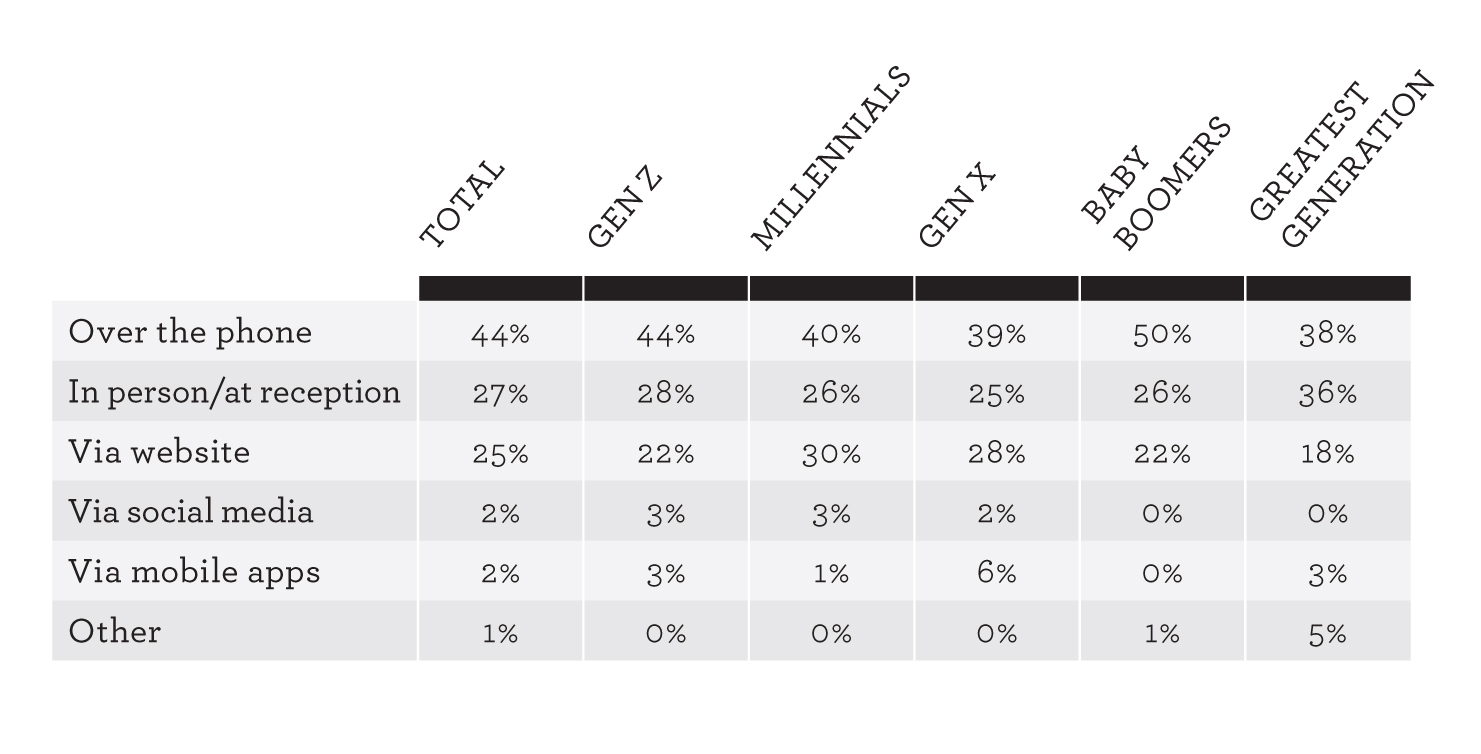

When looking at how spa-goers prefer to book appointments, it appears that the traditional methods are still more popular than more modern digital appointment-making methods (see Table 2). A striking finding is that the data does not demonstrate many differences between the generations when it comes to booking preferences. While gen Z are true digital natives who, from earliest youth have been exposed to the internet, social networks, and mobile systems, they seem no more likely to use digital methods for booking an appointment than any other generation. Forty-four per cent prefer booking over the phone and 28 per cent prefer booking in person versus 44 per cent and 27 per cent respectively at an overall level.

More surprisingly, on average only 2 per cent of spa-goers are using apps to book spa treatments, which is mostly consistent across generations. With the ever-increasing advancements in mobile technology, and an increase in innovative mobile spa businesses, it’s now more important than ever for spas to consider how they can update their infrastructure to take the pressure of manual traditional services.

Balance of power

The generational analysis and the corresponding nuances in behaviour are an important focus of ISPA’s latest Consumer Snapshot Initiative. The results highlight how the generational shift continues to transform the consumer landscape and showcases many opportunities for spas to better cater for their clientele. Millennial and gen X consumers hold the balance of power currently, but the industry shouldn’t lose sight of gen Z as the coming force in the years ahead. With that in mind, spa professionals must continue to think about how they can deliver value for this emerging consumer group and capitalise from new ways of increasing revenue.

Table 1

Source: The Spa-Going Experience, ISPA Consumer Snapshot Initiative, Volume IX. June 2019

Table 2

Source: The Spa-Going Experience, ISPA Consumer Snapshot Initiative, Volume IX. June 2019

ISPA has been producing its Consumer Snapshot Initiative studies for nearly a decade, providing new insights on emerging opportunities that could strengthen the spa economy.

Its ninth edition The Spa-Going Experience was released in June. It was based on interviews with 1,000 spa-goers from across the US. Respondents included the following groups: gen Z, born 1996-present (9 per cent); millennials, born 1982-1995 (24 per cent); gen X, born 1965-1981 (25 per cent); baby boomers, born 1946-1964 (36 per cent) and greatest generation, born before 1946 (6 per cent).

Russell Donaldson and Mia Carter are PwC research specialists based in the UK