features

Splashing Out

Kathleen LaClair and Brian Sands delve into the market potential of multiple waterparks and how such growth can be sustained

Waterpark design is wide ranging. The established traditional, standalone, outdoor waterpark market has been joined by present-day trends for combined water/theme parks and, most recently, the growing popularity of all-season indoor water-based facilities.

Regardless of type, as waterparks typically have lower development costs and higher operating margins than theme parks, it’s no surprise that they continue to be developed, even within markets housing existing waterparks. In fact, in metropolitan areas (barring entertainment markets like Orlando), only one major theme park can typically be sustained compared with multiple waterparks.

As every market differs according to varying degrees of population density, age distribution, disposable income, existing entertainment options and competition – and as every theme park ranges in size and entertainment offering – it’s most likely a combination of all these factors that enables certain markets to successfully support multiple waterparks.

That said, in our experience, market size (i.e. population and tourism) and market competition tend to be the critical factors – so we decided to take a closer look at how individual outdoor waterparks perform within selected multiple outdoor waterpark markets.

On examining numerous US markets, we found that quite a few operators in the outdoor waterpark market perform well despite competition, leading us to surmise that there could be room for growth in other waterpark markets.

Market Attendance

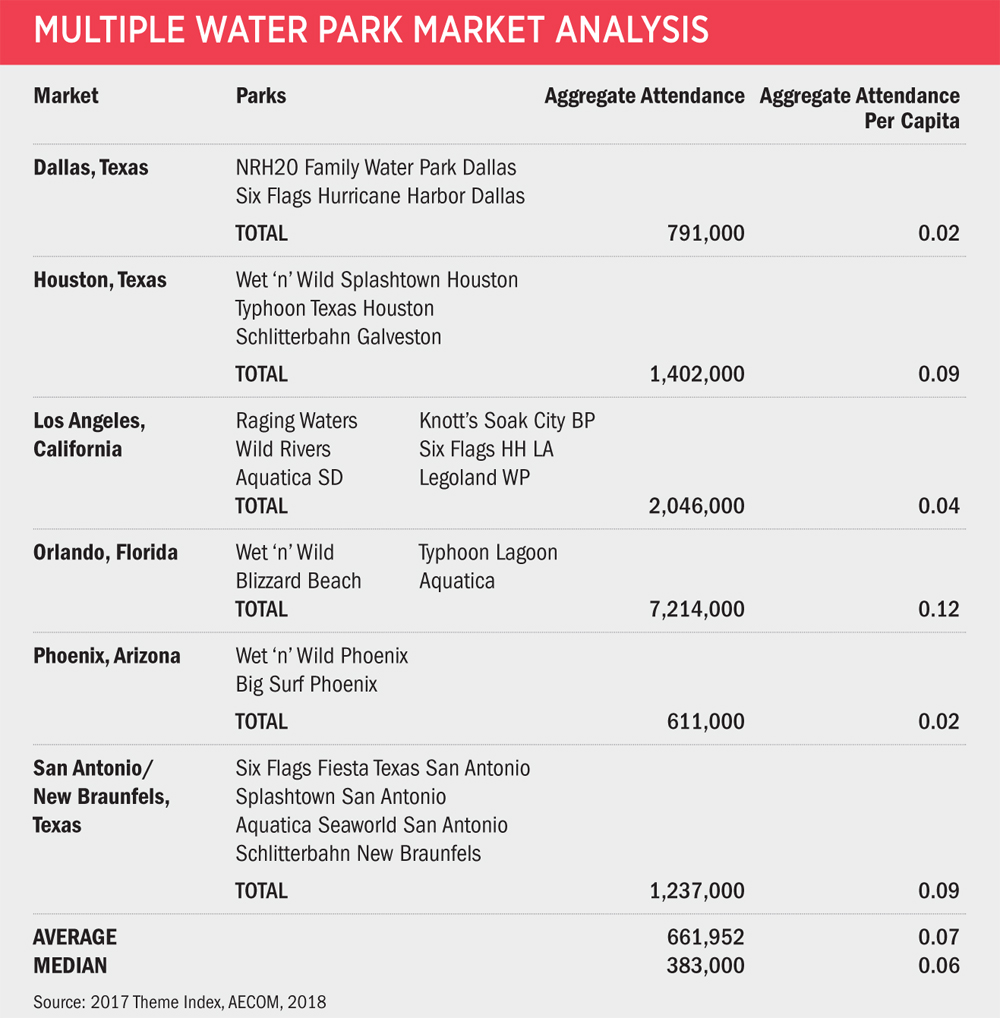

As a starting point, we calculated the aggregate market attendance at outdoor waterparks within select markets, and compared this with the corresponding total market size (metropolitan statistical area population and overnight tourists to the region) in order to calculate the attendance per capita in each market.

We selected six markets (Orlando, Dallas, Phoenix, Houston, San Antonio/New Braunfels and Los Angeles) as each has two-plus large waterparks (see Table). We found that the aggregate outdoor waterpark attendance in each market ranged from about 600,000 (Phoenix) to more than 7.2 million (Orlando). As the market size varied widely, it follows that the aggregate attendance per capita also had a wide range – from 0.02 to 0.12, with an average of 0.07.

This indicates that markets with aggregate attendance per capita figures on the lower end of that range likely have room for additional outdoor waterparks, and that markets with only one outdoor waterpark combined with a lower attendance per capita may even be able to support a second outdoor waterpark.

Of the six markets, Orlando had the highest waterpark attendance per capita, at 0.12, which is foreseeable considering it has four large waterparks and is located within a mega tourist destination. However, Houston and San Antonio/New Braunfels also had high attendance per capita metrics, 0.09 each, despite their more moderately sized total markets. The Los Angeles market has an attendance per capita of 0.04, just below the average. Dallas and Phoenix both came in at 0.02, the lowest of the bunch, and both have notably larger total markets (compared to Houston and San Antonio/New Braunfels), so there may be room in those markets for a further waterpark.

Drive Time

We also examined the market overlap according to drive times in four of the multiple-waterpark markets, specifically Phoenix, Houston, San Antonio/New Braunfels and Dallas, using Geographic Information System mapping analysis.

Although individual behaviour varies, we based our analysis on a one-hour drive time as a sound estimate of the maximum duration most visitors willingly drive to an attraction like an outdoor waterpark. The results revealed that although the one-hour market drive times overlapped by more than 50 per cent in all four markets, the waterparks still achieved robust attendance levels.

This indicates that despite significant competition, it’s possible for several waterparks to operate in relative proximity to each other within an adequately sized and healthy market.

Market Overlap

As stated earlier, Dallas and Phoenix have lower aggregate attendance per capita metrics of 0.2 – so what does their one-hour drive time market overlap look like? Both waterparks in Dallas (Six Flags Hurricane Harbor and NRH20) have a resident market overlap of 90 per cent, so each is competing for almost exactly the same residential base; yet both maintain robust levels of attendance relative to their size and entertainment offering.

In Phoenix, both waterparks (Wet ‘n’ Wild and Big Surf Waterpark) have a 75 per cent overlap in their residential market, and again both perform well in attendance based on their size and entertainment offering. However, although the waterparks are performing well and the aggregate attendance per capita is low, we think it risky to assume there’s room for another outdoor waterpark.

The San Antonio/New Braunfels market had an aggregate attendance per capita metric of 0.9, which is towards the high end of the range. The four outdoor waterparks (Six Flags Fiesta, Splashtown, Aquatica and Schlitterbahn) each have a 50 to 90 per cent overlap in their one-hour drive times, and all four perform well, although Schlitterbahn is the undisputed high performer in that market.

The Houston market has three parks (Wet ‘n’ Wild Splashtown, Typhoon Texas and Schlitterbahn Galveston Island) and the least one-hour drive time overlap at 10 to 50 per cent. As it also has an attendance per capita of 0.9, we consider that the current number of outdoor waterparks is appropriate for Houston.

New Openings

Quantitative and mapping analysis can help to determine the demand potential for new waterparks and, more importantly, where they should be located. It indicates the potential for multiple outdoor waterparks in one market location.

Given the typically robust economics of waterparks globally, we expect the development of new facilities to continue – and it will be interesting to see where these new waterparks pop up both in the US and around the world.

Kathleen LaClair is Associate Principal and Brian Sands is Vice President with the Economics practice at AECOM, which specialises in market and feasibility studies for the themed entertainment and leisure industry.

www.aecom.com/services/economics

@AECOM /AecomTechnologyCorporation