features

EMEA Focus

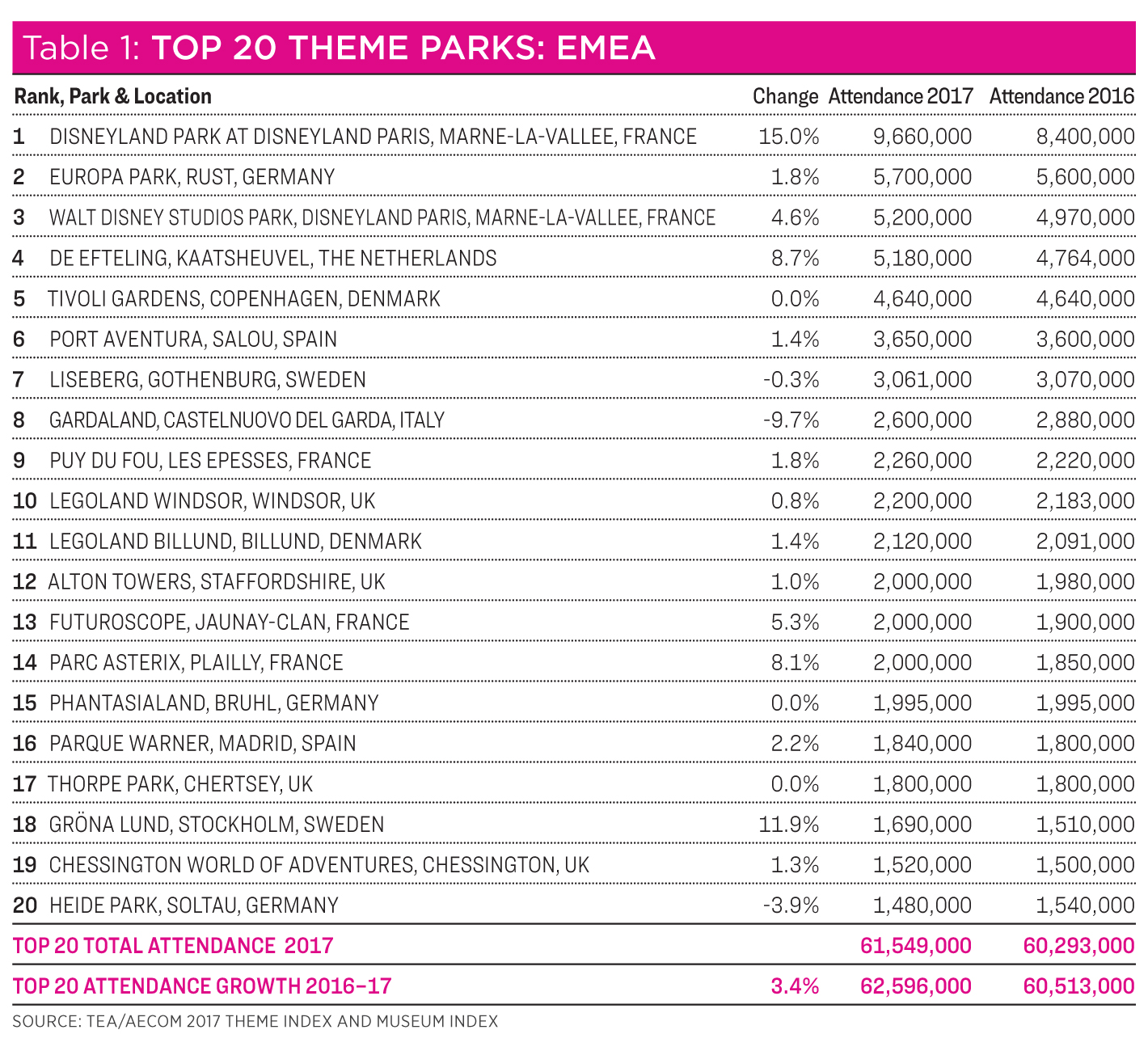

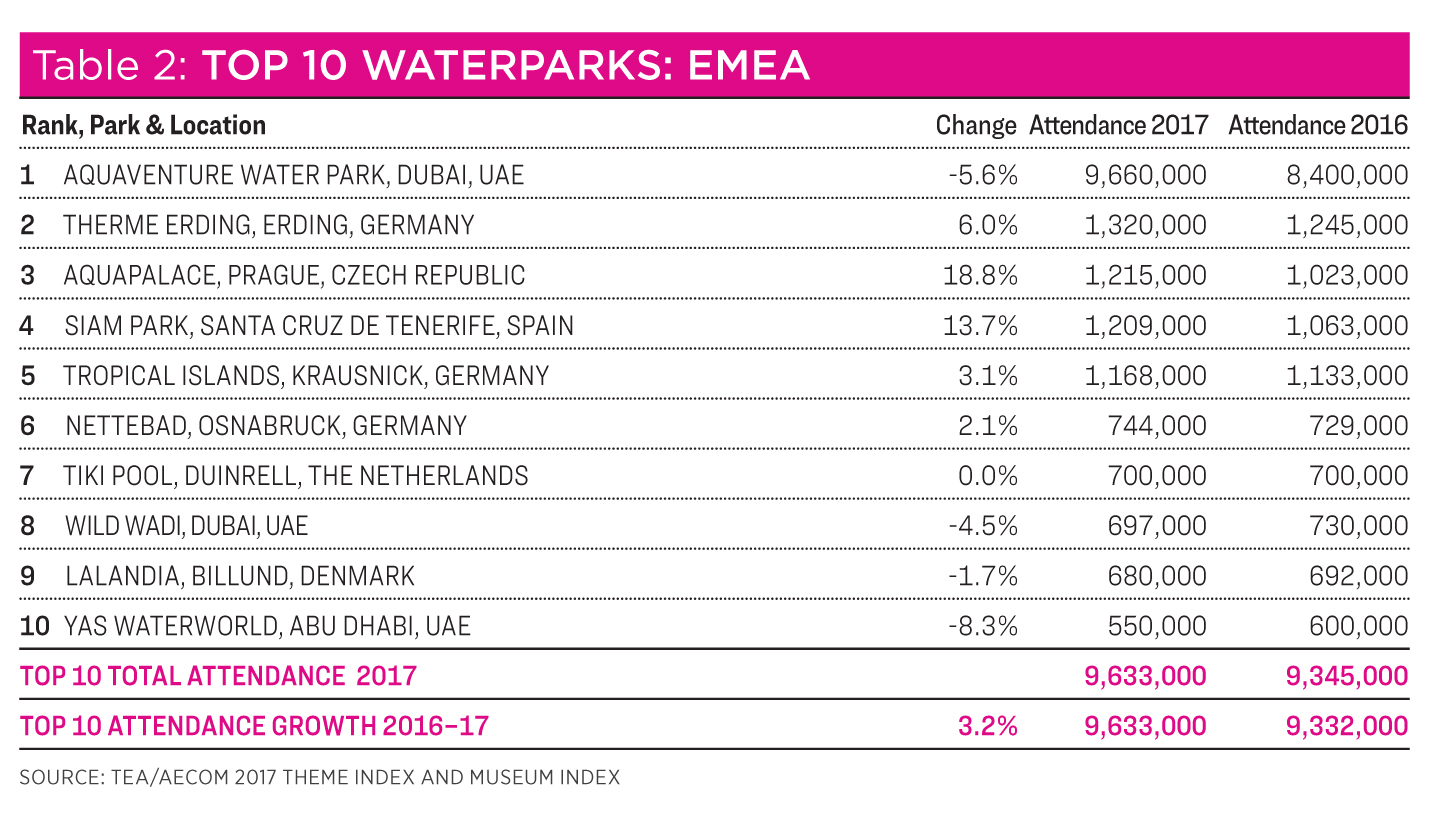

Europe celebrates an active and growing theme park sector with strong attendance at smaller attractions, whereas the domestic tourism market in the Middle East is yet to catch on to the plethora of new offerings. Waterparks across EMEA are seeing marginal growth

Europe

In the UK, it seems that theme parks have not significantly increased their attendance numbers. The usual suspects for flat numbers are bad weather, economic decline and political instability; but the situation in the UK in 2017 was unique. Consumer confidence took a hit both before and following the Brexit vote, and British consumer confidence seems to have remained at a depressed level for the duration of 2017. This loss in consumer confidence may well be the reason behind the lacklustre results in the UK theme park industry.

Competition may be heating up in France. Most French theme parks performed well for 2017, with significant growth of above eight per cent at Parc Astérix following their continued investment, a new ride and additional hotel rooms. Disney too did very well, recuperating from its slide of the prior year. Puy du Fou showed good attendance growth for 2017 at around two per cent but this was the first time in three years that the park did not post an increase of more than five per cent, likely simply because there was no significant new addition to the property. Such high growth rates as Puy du Fou has posted over the past couple of years are nigh impossible to sustain in the longer term. Interestingly, a number of smaller parks in France that don’t quite make it onto our charts grew attendance at higher percentages than the largest parks.

Despite rising consumer confidence in Germany, performance was mediocre if not poor for many parks. In this case, bad weather, especially poor during their peak season, was the likely culprit and given the blame by many operators. We understand, however, that many parks achieved record attendance levels over Halloween, the importance and popularity of which is still increasing.

Italy has been experiencing a bad run economically, and some extremely bad weather combined with some natural disasters during peak season weekends impacted performance in this country, and Gardaland specifically.

In Scandinavia, we observed that some of the most significant increases in attendance happened in the smaller parks that don’t make it into our Top 20.

Perhaps this recurring theme of smaller parks seeing bigger increases in percentage terms is not simply due to the fact that a small absolute increase translates to a large percentage increase. Instead, it could possibly also indicate a general increase in competition for leisure time and spend across the entire European continent.

It may well be that families are limiting their big visits to big parks and increasing their visits to smaller parks, which may help their budgets go further.

Throughout Europe, we get the impression of an active and growing industry with ongoing investment and merger and acquisition activity.

Some specific parks deserve a special mention for 2017:

• De Efteling in the Netherlands celebrated its 65th anniversary and opened, with much fanfare, a new dark ride that subsequently was honoured with a Thea Award – Symbolica: The Palace of Fantasy. This has helped them achieve their 2020 target of five million visits ahead of schedule, recording 5,180,000 visits for 2017.

• Disneyland Paris had a great 25th anniversary year and has recouped the loss in attendance from the previous year.

• Parc Astérix outside of Paris had another good year and managed to break the two million mark in attendance. The continuous investment and effort that Compagnie des Alpes has put into this park is paying off, combined with the additional hotel accommodation offer.

• Gröna Lund in Stockholm had another great year with visitation growth over 10 per cent. They’ve continued to host large concerts with international and Swedish artists. On top of that, 2017 was also the first time they kept the park open for Halloween, which was a great success in Gröna Lund as well.

Confertainment

The addition of leisure and themed entertainment units into retail destinations is adding to the activity levels and innovation in our sector, and continues at a strong pace throughout Europe and the Middle East. We’ve seen further such “merging” between various industries and skill sets with an interesting vocabulary being coined, such as “confertainment” and “architainment”.

Special events are becoming more themed and are now crossing over with the themed entertainment industry. The word “immersive” is developing further, encompassing new types of experiences such as Secret Cinema in London and sound-and-light shows using projection mapping on historic buildings such as cathedrals in Europe.

Middle East

We’ve all been watching events unfold in the Middle East with bated breath, hoping for record attendances to the new theme parks that have opened, notably in the United Arab Emirates.

We have all now realised that the expectations set for this region have proven to be a bit high and, unfortunately, have not been met. Consequently, none of the theme parks in this geography has made it into the Top 20 Theme Parks for EMEA. We hope that with the growth in the tourism market, the theme parks in the Middle East will increase their attendance over time as the tourism industry becomes more familiar with the offer that is now available in this part of the world.

The pipeline in this region is still significant, and we’re seeing evidence of high-quality development, such as Warner Bros World Abu Dhabi. We’ll keep a close eye on this part of the world and look forward to their contributions to the theme park industry in the years ahead.

Europe

Two success stories in the European waterpark category are Aquapalace in Prague and Siam Park in Tenerife. Siam Park is still enjoying the boost in Spanish domestic tourism, and tourism from within the EU that’s returned to affordable European destinations from places perceived as more risky, like Turkey.

For the remainder, our Top 10 waterparks in EMEA reveal marginal growth in attendance. Having said that, we should pay some special attention to the waterparks in Northern Europe with large indoor areas. Many have areas dedicated to what we might dub a “water-focused spa”, wherein many sell entry to the spa area separately from entry to the entertainment area. In our tabulations for this entertainment-focused study, we subtract spa tickets from the total amount of tickets sold, allowing us to make equitable comparisons on an international basis. As a result, some of these operations have total attendance numbers higher than those in our Tables. Notably, Therme Erding – asides from the attendance in Table 2, it receives an additional 500,000 visits to its spa alone.

Middle East

Attendance at Middle Eastern waterparks has decreased. For the larger parks, this is due to a variety of factors, but the significant increase in competition for leisure time and spend has had an impact across the board. Attendance is still strongly driven by residents, even in the Middle East, and the influx of new visitor attractions has spread demand over a larger offer of entertainment. Hopefully tourism will increase, and growing demand from that market will help to absorb the supply that has recently entered the industry.

Margreet Papamichael, former Director of EMEA at AECOM