features

Middle East Research: Spa performance in Dubai and Abu Dhabi has declined, suggests research from Colliers International

Dubai and Abu Dhabi have both seen a decline in spa performance over the past year, according to new research from Colliers International. Christopher Lund and Annie Fernandez outline the findings

Wellness is a dynamic process of making healthy choices in every aspect of life. With consumers understanding the importance of maintaining an optimal level of wellness to lead a higher quality of life, there has been an increasing willingness to spend money on wellness, making the wellness industry one of the fastest growing industries in the world. According to the Global Wellness Institute, the global spa market is nearly US$99bn, and it is expected to grow annually at 5.66 per cent between 2017 and 2021. Given the growing significance of spas in the region, Colliers International Hotels (MENA) launched the Dubai Spa Benchmark Report in 2015. The report features 14 key metrics designed to track spa operational performance, and is based on data received from a spa panel representing a stock of 272 and 92 treatment rooms from Dubai and Abu Dhabi, respectively.

Dubai spa market performance

Overall market performance in 2017

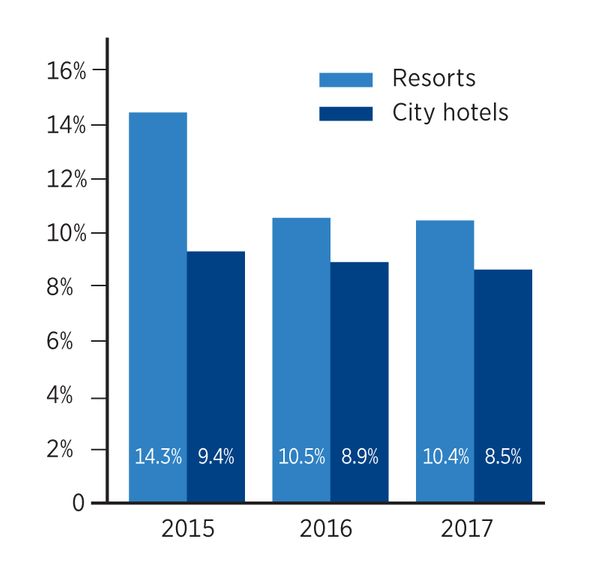

2017 full-year figures reveal that the Dubai spa market has witnessed an overall decline in terms of performance. Dubai spas saw a marginal fall in the average treatment rates (by 1 per cent), owing to an increased number of price-sensitive customers and pressure from new entrants in the market. Moreover, with more promotions, discounts and packages extended by spas, the competition has increased within the industry tremendously.

Average treatment rates fell by 1 per cent, from AED 387 in 2016 to AED 382 in 2017. Demand for spa treatments has also reduced slightly from an average of 29 treatments per day in 2016 to 28 per day in 2017. Moreover, RevPATH has fallen by 11 per cent, dropping the overall spa revenue among Dubai hotel spas.

A closer analysis of the data reveals that the spa revenue has dropped by 20 per cent among Dubai’s resort spas, although the city hotel spas have grown by 5 per cent.

The demand for spas has also shown a slight dip (4 per cent) among Dubai’s resort spas, while the city hotel spas increased by 5 per cent.

Steady demand for city hotel spas

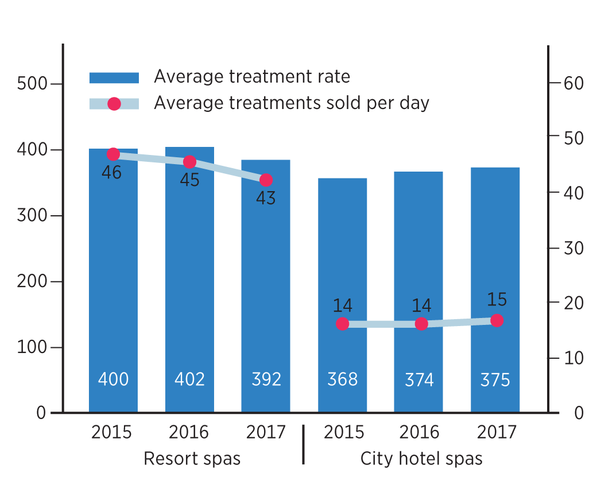

In 2017, resort spas in the sample demonstrated a fall in number of treatments sold. Resort spas have also experienced a 3 per cent drop in average treatment rates from AED 402 to 392. Spas on Palm Jumeirah have remained relatively resilient to the fall compared to the market. Additionally, the average number of treatments sold per day in resort spas fell from 45 to 43 treatments per day, resulting in a decrease in both therapist and treatment room utilisation by 17 per cent and 28 per cent, respectively.

On the other hand, city hotels have been able to maintain a steady customer base, as indicated by the slight increase in number of treatments sold per day, from 14 to 15 treatments per day. Moreover, city hotels experienced a growth in average treatment rate marginally, increasing from AED 374 in 2016 to AED 375 in 2017, resulting in a RevPATH growth of 5 per cent from AED 51 to AED 53.

Resort spas have seen an increasingly important reliance on resident walk-in demand, increasing in share from 40 per cent to 46 per cent from 2016 to 2017. City hotel spas saw the reverse trend, with resident walk-in demand going from 51 per cent of total demand in 2016 to 45 per cent in 2017.

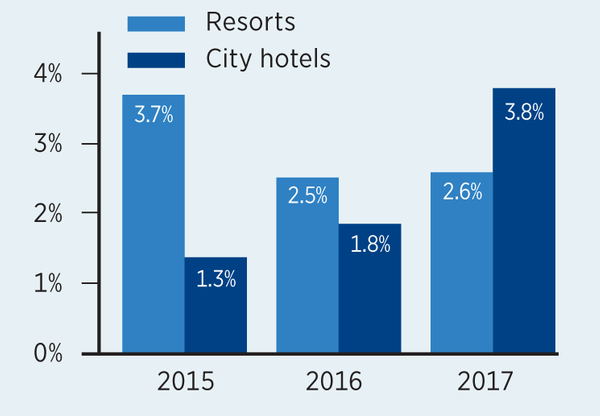

Overall capture ratio of hotel guests by Dubai spas increased by nearly 3 per cent, especially among the city hotel spas, which increased to 3.8 per cent. Retail revenue contribution showed a greater decline in city hotel spas than in resort spas, dropping by 5 per cent in 2017.

The data indicates that city hotel spas still cater to a higher share of price-sensitive demand, despite the increase in average treatment rates observed in 2017.

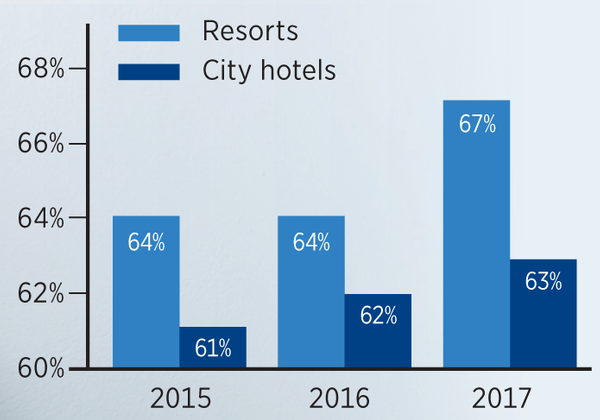

Increasing female spa guests

Dubai spas also witnessed a significant increase in the number of female spa guests over the last three years, especially among the city’s resort spas. This momentum is in line with the global trend, as women have shown increased interest in health and wellness products in the recent years.

Decreasing therapist productivity

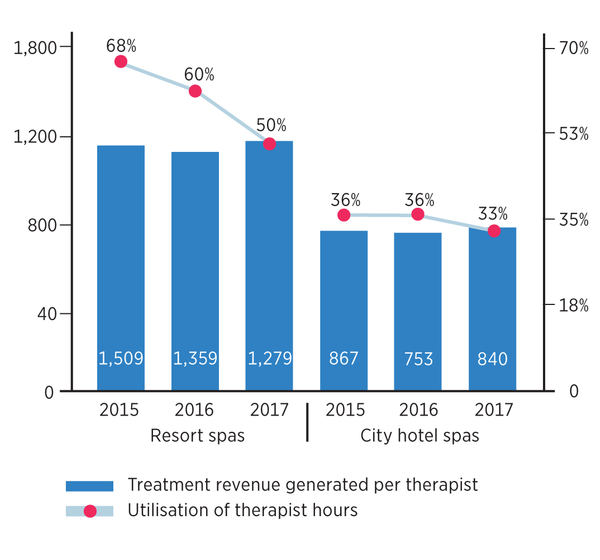

Therapist utilisation is calculated by dividing the available therapist hours for the given period by the occupied therapist hours. 2017 data reveals that the utilisation of therapist hours has fallen in both city and resort spas.

Therapist utilisation in city hotel spas decreased from 36 per cent to 33 per cent in 2017, despite an increase in treatments sold, suggesting lesser efficiencies in staffing. Resort spas experienced a greater fall in therapist utilisation, from 60 per cent to 50 per cent, along with a 6 per cent decrease in treatment revenue generated per therapist.

Resort and city hotel spas in the sample have an average therapist to treatment room ratio of 0.9 and 1.1 respectively. Therapist utilisation rates are higher in resort spas than in city hotel spas, partly due to the higher volume of treatments sold enabling higher efficiencies.

New spa openings in Dubai

While Dubai experienced the opening of several new spas in 2017, including Soul Wellness & Spa at Sheraton Grand Hotel and the Bvlgari Spa, it will witness the opening of the Cinq Mondes Spa at Emerald Palace Kempinski Hotel, the O2 spa at Radisson Blu Dubai Waterfront in Business Bay, the luxury spa at Stella Di Mare, Away spa at W the Palm, and the 2,800sq m spa at Mandarin Oriental Jumeirah Beach in 2018.

New versus established spas

When analysing the data by age, established spas in Dubai (open more than five years) have a 13 per cent premium in rate over new spas (open less than five years) although they sold just 24 treatments per day compared to an average of 43 treatments sold per day by the new spas.

Therapist utilisation rates were 36 per cent in new spas versus 42 per cent in established spas, suggesting greater efficiencies in established spas. New spas have a lower capture rate (2 per cent vs. 3.6 per cent) of hotel guests compared to experienced spas, which may explain the premium in rate established spas are able to achieve.

Abu Dhabi spa market performance

In 2017, Abu Dhabi hotel spas experienced a 2 per cent increase in average treatment rate compared to 2016. However, the treatment revenue per available treatment room dropped by nearly 16 per cent (from AED 927 to AED 781) as the number of treatments sold saw a 22 per cent drop. The figures also suggest that the efficiency of spas in Abu Dhabi has reduced as utilisation of therapist hours has fallen by almost 18 per cent.

On a positive note, Abu Dhabi hotel spas witnessed an increase in the number of walk-in guests by nearly five percentage points, suggesting an increased reliance on the resident population. The retail contribution to the revenue has also seen an increase by 22 per cent compared to 2016.

New spa openings in Abu Dhabi

Several new spas are anticipated to open in 2018, including the Zen Spa at Saadiyat Rotana Resort & Villas, the spa at the Jumeirah Saadiyat Island Resort, and the spas at The Abu Dhabi Edition and Grand Hyatt Abu Dhabi Hotel.

MENA spa market outlook

In March 2018, Colliers International conducted a survey across the spa operators in the Middle East and North Africa (MENA) region to understand the sentiment of the market in terms of the top three challenges faced in 2017 and their outlook for the coming year. The below analysis is based on the 37 responses received from the survey.

Thirty-two per cent of city hotel spas responded that the biggest challenge in 2017 was the increase in price-sensitive customers. Twenty-four per cent also felt that new entrants into the market have increased the competition level, and therefore had trouble retaining their customer base. Finding the right talent was the next-biggest challenge.

Twenty-eight per cent of resort hotel spas consider finding the right talent and increase in price-sensitive customers as the two biggest challenges that affected them in 2017. Increasing competition due to the new entrants was the next-biggest challenge for the resort spas.

The outlook for the spa market looks positive given that more than 40 per cent of the respondents consider that spa revenue will grow in 2018. However, there is a significant variance in 2018 outlook, which means that the market has become more volatile and less predictable. There is almost an equal distribution between respondents who predict an increase in spa revenues (40 per cent) to those who do not expect any change (31 per cent) and those who expect a decline (23 per cent).

Graph 1:

Retail revenue contribution*

Graph 2:

Treatment Revenue Indicators*

Graph 3:

Therapist utilisation*

Graph 4:

Female spa guests*

Graph 5:

Capture ratio of hotel guests*

About Colliers International Hotels (MENA)

Colliers International is a global leader in commercial real estate services, which includes a hotel division of specialist consultants in hotel, resort, marina, golf, leisure and spa sectors. The consultants provide strategic advice on everything from market feasibility and operator searches to budget analysis and asset management. In MENA, the hotel team has offices in Dubai, Abu Dhabi, Jeddah, Riyadh, and Cairo.

Details: http://www.colliers.com/engb/unitedarabemirates/services/hotels

About the authors:

Christopher Lund is the associate director of Colliers International Hotels (MENA) and Annie Fernandez is a senior analyst in the same division.

Email: [email protected]

Tel: +971 4 453 7400