features

Source Market

Growth in the spa industry is shifting geographically, but which regions have the strongest markets and how are the others faring? Katherine Johnston delves into data from the 2014 Global Spa & Wellness Economy Monitor to find out

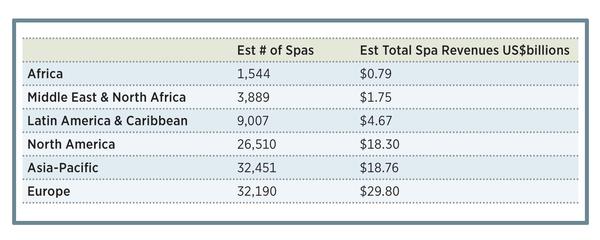

Great news – after the significant economic, financial and geopolitical turmoil over the last eight years, the global spa and wellness industry is not only surviving but thriving. When SRI International and the Global Wellness Summit first published data in 2007 on the size of the global spa industry, the sector had reached peak levels just before the recession (see SB08/4 p40). Updated data released in September in the Global Spa & Wellness Economy Monitor reveals that the sector is stronger than ever. Between 2007 and 2013, the global spa industry has expanded from US$60bn (€53bn, £39bn) to US$94bn (€83bn, £61bn), posting an annual growth rate of 7.7 per cent that’s much faster than the global GDP growth at 4.6 per cent annually (see SB14/4 p94).

Yet the industry today looks very different than it did prior to 2007. Growth has shifted from North America and Europe to the rest of the world. Along with this shift have come new services, products, and business models driven by the unique characteristics, consumer needs and competitive forces in different markets. Authentic and local products and services are increasingly valued by consumers; these are changing the look and feel of spa facilities and service menus and they’re carrying traditional offerings across borders to new audiences. Across the world, the spa industry is also moving beyond its conventional image of pampering and luxury and is embracing a more holistic and expansive approach to wellness and prevention, bringing its offerings to a far broader consumer base. These trends are playing out in different ways in different regions around the world.

Europe

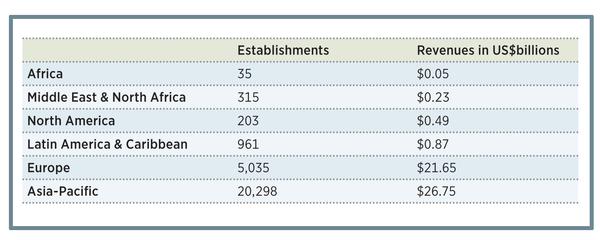

Home to 32,190 spas in 2013, Europe leads the world in spa revenues (US$29.8bn or €26.2bn/£19.4bn in 2013) and employment (679,000 staff). It’s also home to about 5,035 thermal/mineral springs establishments. In the face of shrinking government support, some of these traditional spring facilities are being remodelled and repositioned as modern, spa-focused wellness and holistic health centres, with greater appeal to a wider, modern consumer base. Meanwhile, there’s strong growth in the day spa and urban spa market across the region.

While most western European countries have maintained steady spa market increase in the face of a sluggish economic environment, the major growth story has come from the east of the region. A growing middle/upper income consumer base is fuelling day spa and luxury resort/hotel spa growth across Russia and eastern Europe. Booming energy economies are bringing investor interest from central Asia and many new hotel/resort spa projects are on the horizon in these countries as their tourism markets rapidly expand.

Asia-Pacific

Asia-Pacific leads the world in new spa openings, adding over 10,000 new spas since 2007. Today, it also hosts the largest number of spas (32,451 in 2013) and ranks second globally in revenues (US$18.8bn or €16.5/£12.2). In the same year, it employed 614,000 workers.

Growth has been led by the hotel/resort sector, fuelled by the rapid rise of intra-Asian tourism. The number of hotel/resort spas in Asia-Pacific more than doubled from 2007-2013. With the exception of a few countries that were harder hit by the recession (Japan, Hong Kong, Singapore, Australia and New Zealand), in most Asian countries spa revenues have grown faster than the economy. The market giant, China, has seen its number of spas double from 2007-2013 and it now accounts for close to one-third of all Asian spas. China’s expanding middle class and rapid tourism growth mean that industry investment will continue.

Building on traditions, hot springs are a huge focus for investment in China. Over 200 new hot springs resorts are slated to open, all of which offer spa-like services, but catering to Chinese consumer tastes. Japan is also a world leader in hot springs, as the home of over 17,600 onsen, which account for two-thirds of all thermal/mineral springs establishments in the world. Together, China and Japan represent more than half of global thermal/mineral springs industry revenues.

North America

North America is the world’s third largest spa market, with 26,510 spas, US$18.3 (€16.1bn, £12bn) in revenues and 489,100 employees in 2013. It was hit hard by the recession and new competitive pressures are changing the shape of the industry dramatically. Growth has largely been in the day spa category, driven by the rapid rise of franchised spas such as Massage Envy, Woodhouse, Massage Green and Hand & Stone. Increased competition is also coming from the proliferation of lower-price single service establishments such as facial clinics and pop-up massage stations in shopping malls, as well as from gyms, doctor’s offices and other businesses adding spa services. These shifts are democratising the market and expanding the consumer base, making spa and wellness accessible to middle income consumers at a variety of price points and to meet a variety of needs.

Latin America & Caribbean

Spa industry growth is robust in Latin America and the Caribbean, with more than 3,500 spas opening since 2007. Today, the region is home to 9,007 spas, with US$4.7bn (€4.1bn, £3.1bn) in revenues and over 141,000 employees. Top markets, such as Brazil, Argentina, Colombia, Venezuela, Chile and Mexico, are seeing a convergence of the day spa, aesthetic clinic and salon markets as a variety of traditionally beauty-focused establishments add spa-like services. Meanwhile, tourism growth is driving the continued dominance of the hotel/resort spa sector across the Caribbean and in Mexico.

Latin America’s Andes region boasts a wealth of thermal water resources and is home to 961 thermal/mineral springs establishments. These are largely recreational (thermal waterparks, swimming pools) and serve a local and regional clientele, and they’re little known outside the region. These sites are increasingly recognised as a new frontier for investment in upgrading facilities and adding spa/wellness services, expanding their appeal to a broader regional and international wellness-focused consumer base.

Middle East & Africa

The world’s smallest spa markets in size, the Middle East and Africa also boast the highest growth rates.

Middle East and North Africa more than tripled its number of spas since 2007, reaching 3,889 spas and US$1.7bn (€1.5bn, £1.1bn) in revenues in 2013. The region’s spa market continues to focus on luxury, relaxation and pampering. Driven by rapid economic and population growth, rising incomes, tourism growth and relatively stable political environments, countries such as the UAE, Morocco, Saudi Arabia and Israel are leading the region’s growth trend. Strong inbound tourism from Europe, wealthy Asians and Gulf countries has brought massive investments in hotel/resort spas, while the region’s burgeoning middle/upper middle class is driving strong day spa growth.

Across sub-Saharan Africa, spas have proliferated in many countries where the market hardly existed just a few years ago. Since 2007, the number of spas in sub-Saharan Africa has quadrupled to 1,544, driven by economic and tourism growth. Day spas are expanding rapidly in countries with strong economic performance and an expanding middle class (South Africa, Ghana, Nigeria), while hotel/resort investments are driving growth of the hotel/resort spa sector in countries such as Kenya, Namibia, Tanzania, Uganda and others.

What next?

The trends that have supported spa industry advancement through the recession and beyond will continue to fuel the industry’s ongoing expansion through the next decade. These trends will also continue to change the face of the industry. The developing world will continue to grow its share of the spa market. Spa and wellness services will continue to be made available in a range of new venues and through new business models and will employ a wider array of local/traditional practices.

But perhaps the most important driver – and the biggest unknown – is the global health crisis, which is only beginning to propel consumers and policymakers to explore different and more effective paradigms for prevention and wellness. The spa industry has much to offer and an important role to play in this burgeoning global conversation. How spa businesses and industry leaders embrace and respond to the growing health imperative may be the most important factor in how the industry will evolve and thrive in the coming years.

Table *:

Spa Facilities and Revenues by World Region (2013)

Source: *2014 Global Spa & Wellness Economy Monitor, SRI International

Table *:

Thermal/Mineral Springs Facilities and Revenues by World Region (2013)

Source: *2014 Global Spa & Wellness Economy Monitor, SRI International

About the author:

Katherine Johnston is a senior economist at SRI International. She has 14 years of experience in industry analysis and economic modelling internationally. She has led six key spa studies for the Global Wellness Summit, including the 2014 Global Spa & Wellness Economy report.

Email: [email protected]