features

Destination: Wellness

SRI International gives an overview of what world regions are set to become wellness tourism hot spots in the years ahead and how businesses can tap into these markets

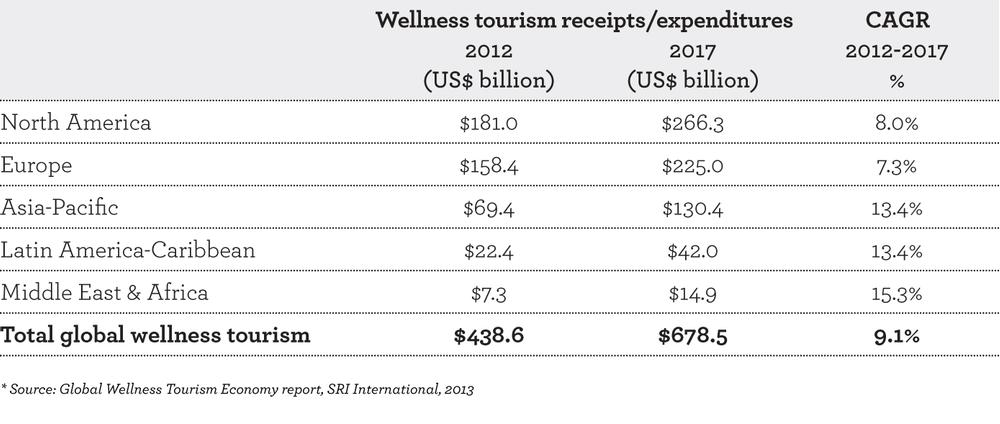

Consumer interest in wellness is a rising tide that will drive the growth of wellness tourism in 2014 and beyond, creating opportunities for many businesses. According to the Global Wellness Tourism Economy study, conducted by SRI International for the Global Spa and Wellness Summit in 2013, wellness tourism is a US$439bn (€319bn, £263bn) market, accounting for 14 per cent of global tourism expenditures.

SRI projects that wellness tourism expenditures will grow at a 9 per cent rate through 2017, much faster than the overall forecast for global tourism at 6 per cent. Businesses and regions that want to take advantage of this trend must understand what wellness travel is, why it’s growing and how destinations can benefit the most from this burgeoning travel segment.

What is wellness tourism?

SRI defines wellness tourism as “travel associated with the pursuit of maintaining or enhancing one’s personal wellbeing”. This is not to be confused with medical travel, which is primarily undertaken by patients who are seeking treatment for a diagnosed disease and who are motivated by a lower cost of care or higher quality care than what is available at home.

On the other hand, it would be a mistake to think of wellness travellers narrowly as a subset of well-heeled travellers who check into destination spas such as Kamalaya, in Asia or Canyon Ranch, in the US for a week of rejuvenation, pampering or detox. True, these are the “primary wellness travellers,” who make their travel plans and choose destinations with wellness as their primary intention. However, the research shows that “secondary wellness travellers” constitute a much larger group of consumers who shouldn’t be ignored. While wellness may not be the primary motivation for their trip, secondary wellness travellers are interested in maintaining or improving their wellbeing wherever they go, so they carry a variety of wellness needs and interests with them as they travel. An example would be a businessperson who actively seeks out healthy accommodation, food and fitness options during a trip. SRI estimates that these secondary wellness travellers make up 85 per cent of all wellness trips.

Spa tourism is a subset of wellness tourism and includes both those travellers who are visiting a destination spa (primary wellness tourism) as well as tourists who simply want to receive a massage or body treatment during their vacation (secondary wellness tourism). However, wellness tourism is also much broader than spa tourism and includes other activities such as meditation, exercise, healthy eating and even outdoor activities or volunteering – essentially, any tourist activity done with the aim of enhancing one’s personal wellbeing during a trip.

Why the growth?

The rapid growth of wellness travel is fuelled by a convergence of demographic, economic, social and lifestyle trends. Across the globe, chronic diseases associated with a stressful and sedentary modern lifestyle such as diabetes and hypertension are on the rise, igniting consumer consciousness and lifestyle changes. In high-income countries, ageing and the failure of conventional healthcare systems to deliver preventive care mean that consumers must take a more proactive approach to take care of their own health and wellbeing. In the emerging markets, rising income and education levels are expanding consumers which fall within the LOHAS (lifestyles of health and sustainability) segment as well as people who demand for experiential travel. Increasingly, consumers are seeing vacations as an extension of their healthy lifestyle and an opportunity to elevate their health and fitness routine.

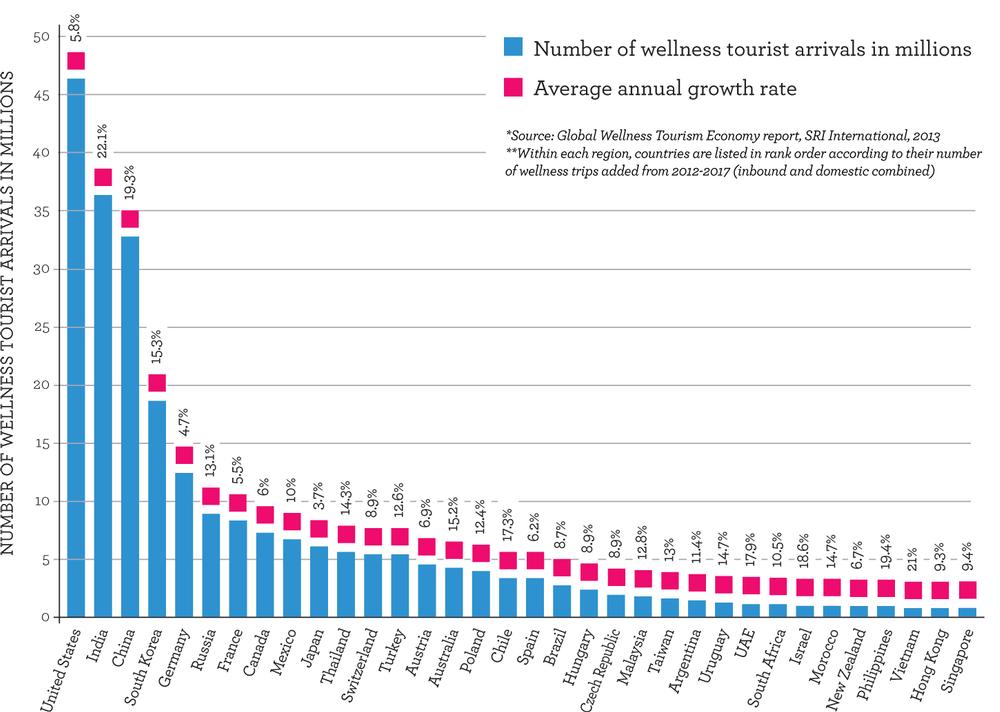

Wellness tourism at present is very concentrated in the countries with the most well-developed wellness consumer markets. In fact, the top 20 countries for global tourism account for 88 per cent of the global wellness tourism market and these are predominantly in North America, western Europe and in high-income Asian countries – as illustrated by the regional market sizes shown in Table 1. It should be noted that much of the wellness tourism that takes place in these regions is domestic and intra-regional trips.

Where is it growing?

Future growth will be driven by emerging markets. Through 2017, over half of the growth in the number of wellness tourism trips will occur in Asia with a 43 per cent increase in trips; Latin America with an 8 per cent rise; and the Middle East/North Africa regions with 2 per cent of growth.

Graph 1 provides a visual overview of what countries and world regions will have the biggest increase in the number of wellness tourists through 2017. We take a look some of the reasons for this growth, as well as current market success, below.

North America

At present, North America is the world’s largest wellness tourism market as measured in expenditures – US$181bn (€132bn, £108bn) in 2012 – and the second largest in terms of trips (163 million). More than 90 per cent of wellness trips in North America are made by domestic travellers, who tend to take short-haul trips and weekend getaways.

Ironically, while the North American spa market is well developed and consumers have a solid understanding of how to stay healthy, the country is still ranked as having one of the most unhealthy populations in the world as its people have not yet fully embraced a wellness lifestyle. Many ageing baby boomers and maturing gen X-ers – those who are now aged in their early 30s to late 40s – are becoming increasingly wellness-conscious and expect to carry on with their healthy eating, exercising, sleeping, pampering and relaxing while they are on vacation and travelling for business.

Wellness tourism expenditures in North America are projected to grow at a healthy 8 per cent rate annually over the next five years (see Table 1). Many hospitality brands are already catering to this segment by offering an increasing range of wellness amenities such as fitness and spa facilities and healthy eating options that allow guests to continue their wellness routines while away from home.

Europe

Europe is the second largest regional wellness market in expenditures – US$158.4bn (€115.1bn, £95bn) in 2012. It’s also the largest in terms of trips (202.7 million) and is expected to experience continued growth.

Europeans have long traditions of water-based treatments that are a foundation for their interests in wellness and wellness tourism, such as the centuries-old ‘heal stays’ and ‘kur (cure) programmes’ in central and eastern Europe. In addition, the governments in Europe also have a history of subsidising wellness-related travel as part of routine and therapeutic healthcare. However, it’s worth noting that this subsidisation has been in decline in the eastern and southern European countries of late. As a result, traditional establishments are now being forced to reinvent themselves for new wellness tourist markets.

SRI estimates that over 75 per cent of wellness trips in Europe are for domestic travel. With a sophisticated understanding of wellness and prevention, Europeans are also probably the largest source market for outbound international wellness travel. Some countries – such as Switzerland, Austria, Germany, Hungary, Finland and Slovenia – also actively promote wellness tourism. Other countries are expected to follow suit, drawing on natural assets such as hot springs and mineral waters and unique traditions.

Asia-Pacific

Asia is the third largest regional market for wellness tourism in terms of both expenditures – US$69.4bn (€50.4bn, £41.6bn) in 2012 – and trips (120 million). Countries draw from a wealth of wellness traditions and knowledge, from yoga and ayurveda to traditional Chinese medicine and Thai massage, that date back thousand os years.

The majority of wellness tourism in Asia is domestic and intra-Asia trips. Less than 15 per cent of the wellness trips in Asia are undertaken by international visitors and these predominantly come from Europe and Australia and, to a lesser extent, North America.

The rapid rise in income and education levels in the emerging markets is expected to drive wellness tourism growth in Asia, with a projected 13.4 per cent annual growth in expenditures over the next five years. Businesses that are able to deliver authentic and locally-rooted services and treatments, and package them at various price points, can expect to see strong growth from international travellers as well as domestic visitors.

Latin America & Caribbean

Latin America and the Caribbean is the fourth largest region for wellness tourism expenditures – US$22.4bn (€163bn, £13.4bn) in 2012 – and trips (31.7 million).

This region will see strong growth, with 13.4 per cent annual growth in expenditures through 2017: albeit from a much smaller base than the three largest regions. International wellness travellers account for almost 30 per cent of all wellness tourism trips in this region and most of these originate from other Latin American countries, North America and Europe.

Latin American consumers tend to associate wellness with beauty, pampering and luxury, but will likely evolve toward more holistic approaches with rising incomes and growing consciousness of health and prevention. The growth of wellness tourism in this region can leverage and tap into its rich biodiversity and indigenous traditions, which are already supporting a vibrant and growing eco, adventure, and active-travel market.

Middle East & Africa

While the Middle East & Africa wellness tourism market is relatively small – US$7.3bn (€5.3bn, £4.4bn) expenditures, 7 million trips in 2012 – it’s expected to post the highest expenditures growth rate through 2017, at 15.3 per cent annually.

The region attracts mostly international tourists who account for more than 60 per cent of all wellness trips. There’s a long tradition of therapeutic hammam and Turkish bath experiences, but the concept of holistic wellness is still nascent here.

In recent years, many Gulf countries have seen massive infrastructure investments and the construction of resort and residential developments with extensive spa, fitness and recreational facilities. Many of the new businesses target well-heeled travellers from the surrounding regions of Asia and Europe (especially Russia).

On most of the African continent, wellness and spa are still burgeoning concepts outside of South Africa. Much of the market is dominated by European leisure travellers, such as in Tunisia and Morocco, or linked with safari/adventure tourism, such as in South Africa and Botswana. With the growth of unhealthy lifestyles and chronic diseases that accompany rising incomes, the concept of wellness and wellness tourism are only going to gain ground throughout the Middle East and Africa as their economies grow.

ABOUT THE AUTHORS

Ophelia Yeung has led global research and consulting projects for more than 20 years. She’s a senior consultant at SRI International and was a co-researcher on The Global Wellness Tourism Economy study. She specialises in competitiveness and innovation strategies for regions and industries.

email: [email protected]

Katherine Johnston is a senior economist at SRI International. She has 14 years of experience in industry analysis and economic modelling internationally. She has led five key spa studies for the Global Spa & Wellness Summit, including the Global Wellness Tourism Economy report.

email: [email protected]