features

Demographics: Health Benefits

A new report from Sport England shows that the poorest groups are still much less active than affluent groups. We take a look at why targeting this demographic not only benefits these individuals, but can also provide financial growth for leisure centres

According to Sport England’s latest National Benchmarking Service (NBS) report, the leisure industry still isn’t reaching the lowest socio-economic groups. The low representation of these groups has not significantly changed over the last few years, which means it’s a demographic the leisure industry must actively attempt to engage in order to increase levels of participation.

Worryingly, the NBS report found that only 54 per cent of people from the lowest socio-economic group (NS-SEC 6&7) who attended leisure centres were active for at least 150 minutes per week, compared with 70 per cent of the higher socio-economic groups (NS-SEC 1&2).

Leisure-net, which carried out the study in partnership with the Sport Industry Research Centre (SIRC) at Sheffield Hallam University on behalf of Sport England, provides customer insight to the UK’s active leisure, fitness and cultural service industries. Director Mike Hill says: “This is a significant and meaningful difference. On a simple level, the NBS identified that barriers to participation in physical activity include high costs and poor access to facilities. However, there is much evidence to suggest issues relating to social identity and self-esteem have a great influence too.”

The London School of Economics Housing and Communities research department carried out an in-depth study on the impact of poverty on access to sport in 2015, on behalf of the sports charity Street Games. It found that, as well as the financial restrictions, emotive factors including fear of failure, a lack of role models, stigma and peer pressure played an important part in young adults’ low participation levels in sport in the poorest areas of the country.

Learning from This Girl Can

The NBS previously identified a low score for women’s participation in physical activity; insights that confirmed Sport England’s own findings of how the active leisure industry was failing women. “The Sport England 2015 This Girl Can campaign was very successful, changing consumer behaviour and inspiring women to be more active by breaking down barriers and preconceptions, using strong and focused marketing messages to target a group,” says Hill.

As a result of the campaign, Sport England’s Active People Survey found the number of women playing sport began increasing faster than men. The latest NBS also found women are now over-represented in visiting public sport and leisure centres. “The leisure industry could look at this approach and apply it to low income groups,” says Hill. “This Girl Can was a success due to its carefully targeted approach. A similar model could work for other underrepresented groups.”

A societal issue

Leisure operators agree that low income groups are difficult to reach and that eliminating barriers to physical exercise among low income communities is a multifaceted challenge. However, it’s also an area for potential financial growth, with the additional possibility of funding from government think tanks and schemes.

Hill believes operators must refine their offers, marketing strategies, opening hours and staffing policies to make exercise and healthy lifestyle choices more attractive and less intimidating to this socio-economic group. “This isn’t just a leisure centre problem, this is a societal issue,” he says. “Health messages in general aren’t reaching this group. The active leisure sector must work out how to target this group, as its failure to engage with the less affluent classes is leading to long term health and societal implications.”

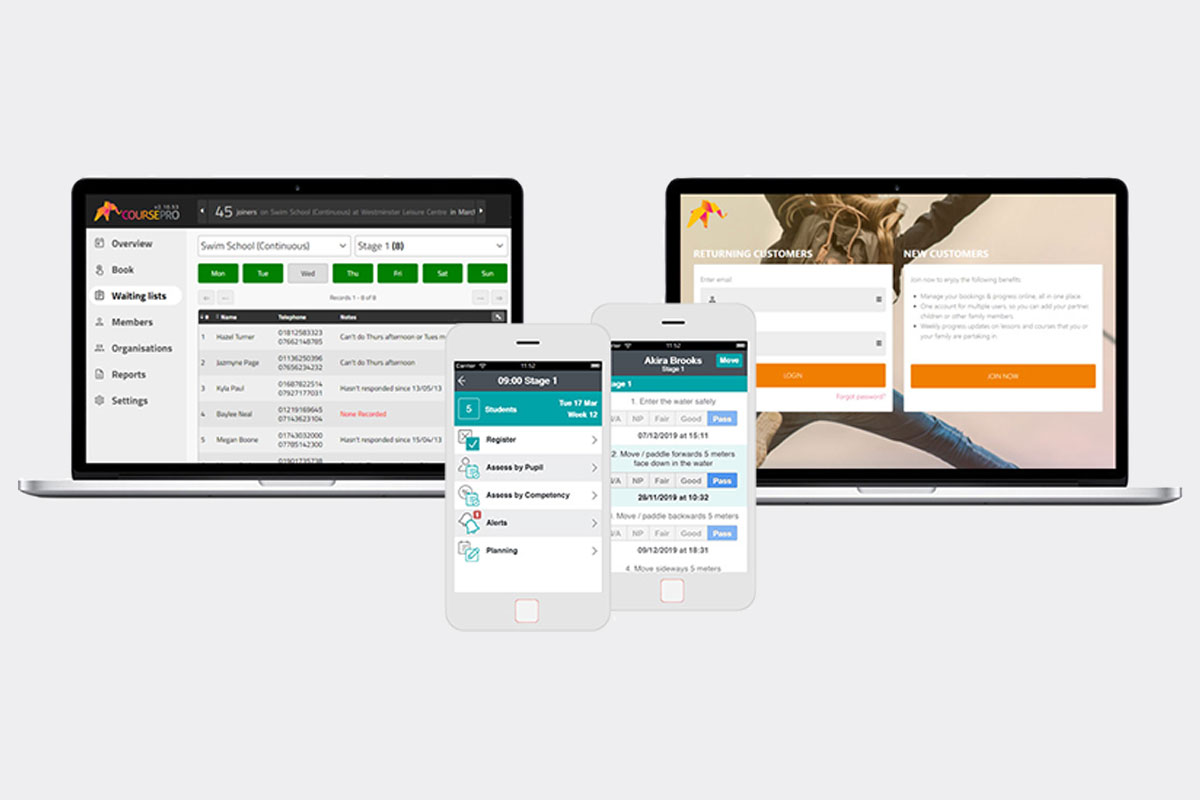

DataHub’s head of sales, Chris Phillips, agrees that understanding your market is essential. “We operate in a data-rich, information-poor sector. Data is at the heart of any successful leisure operation, and any potential marketing strategy.”

Geo Impacts

DataHub’s Geo Impacts uses national and regional data based on throughput and percentage increase in participation from more than 500 million visits to leisure facilities in the UK. It utilises the data for live mapping and demographic profiling in order to identify potential customers and the activities they want to take part in. It can accurately identify locations with underrepresented demographic groups, as well as trending sports and activities. It can also specifically help identify where there are customers in high deprivation or at high risk of inactivity – as well as understand the type of activities that bring those customers to physical activity.

Geo Impacts shows that the top participation sports for people in the most deprived areas are football and swimming, and that group workout classes are less attended by these groups. It also tells us that, although women’s presence in physical activity rates has increased, there is still a significant difference – 33 per cent – between women in the most and least deprived areas across all participation levels.

“Our data backs the NBS findings that overall participation is higher for those who live in the most affluent areas,” continues Phillips. “It shows there’s no ‘one stop shop’ solution for people in low socio-economic groups, as age, gender, race and disability also impact participation data for this group. But this snapshot of participation data can be used by leisure operators to design and develop targeted offers and activities.”

Targeting programmes

Places for People Leisure (PfP) is a great example of how targeting specific groups and activities can increase participation, having used the NBS alongside strategic cultural tactics and trends in deprived areas across its Rotherham contract with some impressive results.

Mark Rawding, Rotherham contract manager for PfP explains. “Using the NBS on a local scale allows us to gain an understanding of participation, and in turn use this data to devise a plan to ‘enable’ hard-to-reach target groups.”

The NBS identified the exact participation in the community surrounding each leisure centre. PfP then developed a strategy to target activities aimed at various underrepresented groups. It ran a variety of taster sessions, including tennis sessions for teenagers, Bollywood Dancing for black and minority ethnic (BME) women and boot camp sessions for females and the over-50s.

“We created a link with a local United Multicultural Centre, which aims to generate participation opportunities for those facing religious or cultural barriers, and conducted two lots of eight-week dance classes, signposting participants back to the same session with the same instructor at a discounted rate within our centre,” states Rawding. “As a result we activated 27 BME families in an area of deprivation, improved our internal stats on Social Class 6 & 7 participation and now expect to increase our NBS score in both areas.”

Attracting new customers

The team at Aston Leisure Centre ran a music and movement session for preschool-aged children, initially operating from a local Sure Start hall in a deprived area. Thirty-two families participated, and of those, eight families have continued the sessions in the leisure centre.

So it seems there is no single, simple strategy for reducing physical activity disparities between the socio-economic groups. A multifaceted group will require a multifaceted solution. Data analysis can, however, help operators develop relevant offers and target marketing.

Phillips concludes: “Whether it’s to attract new customers or retain existing members, knowing the right activities and channels of communication that are specific to your target groups ensures reduced costs and increased customer satisfaction. Having decisions informed by strategic intelligence makes for a much smarter operator.”

54% of people from the lowest socio-economic group (NS-SEC 6&7) were active for at least 150 minutes per week.

In comparison, 70% of the higher social groups (NS-SEC 1&2) achieved this level of activity

Data sourced from Leisure-Net Solutions Ltd & NBS

Top trending participation sports for the most deprived areas are football and swimming

Group workout classes are less attended by lower socio-economic groups

Data sourced from DataHub & Leisure-Net Solutions Ltd