features

US Research: Colin McIlheney outlines the findings from ISPA’s annual ‘Big 5’ study

Total spa industry revenue in the US has reached an all-time high of US$16.8bn, according to the latest research from ISPA and PricewaterhouseCoopers. Research author Colin McIlheney outlines the findings

It’s been another year of steady growth for the US spa industry, according to the International Spa Association (ISPA)’s 2017 US Spa Industry Study, which was carried out in collaboration with PricewaterhouseCoopers (PwC).

The report is a nationwide overview of the spa industry and looks at data for 2016 through spring 2017. The findings are the result of a large-scale survey of spa operators across the US. Criteria examined include financial performance, employment and growth, as well as the regional distribution of spas, ownership structures, number of visits, product and service offerings, compensation, and other topical areas of interest.

With continued growth in the US economy in 2016 seeing overall GDP continuing to rise and unemployment falling further, this year’s estimates show that the spa industry grew in tandem with the wider economy. Revenues, visits, employment and locations all increased, marking further progress for the industry and representing a seventh year of positive growth following the decline that resulted from the Great Recession in 2008-2009.

The five key statistics

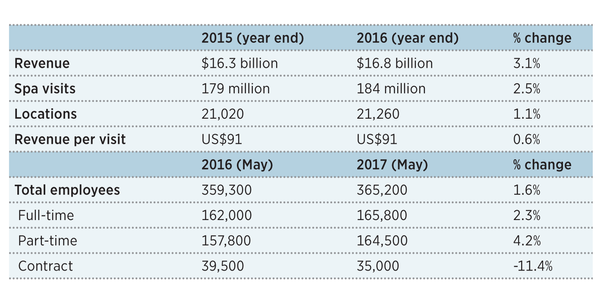

In this year’s study, each of the ‘Big Five’ statistics increased on the previous year’s figures, underscoring the industry’s continued growth. Total spa industry revenue in the US is estimated to have reached US$16.8bn in 2016 – an all-time record figure. Growth in the overall US economy slowed slightly in 2016, with GDP growth falling from 2.6 per cent in 2015 to 1.6 per cent in 2016, and this trend was matched in the spa industry, with revenue growth slowing from 5 per cent in 2015 to 3.1 per cent in 2016.

In addition to revenue, record-high figures for the industry were also recorded in relation to visits, locations and revenue per visit. With five million additional visits made to spas in 2016, the number of visits grew to 184 million in 2016, representing a 2.5 per cent increase on the previous year’s figure. These increases in both revenues and visits helped revenue per visit to rise by 0.6 per cent to US$91.30.

With employment in the wider US economy increasing by 1.8 per cent in 2016, the spa industry kept pace with a 1.6 per cent increase in employment, meaning that 365,200 people now work in US spas. There was steady growth in both the number of full-time (+2.3 per cent) and part-time (+4.1 per cent) employees, coupled with a further fall in the number of contractors (-11.4 per cent). In recent years the part-time workforce has seen a more rapid rate of growth than full-time employment, so the number of part-time employees in spas is now just shy of the number of full-time employees.

There was a net increase of 240 new spas in 2016, equating to more than four new spas opening each week, so there are now 21,260 spas in the US (+1.1 per cent). This is just shy of the record of 21,300 spas in 2008, just before the Great Recession. Almost four in five spas in the US are day spas (79.6 per cent), followed by resort/hotel spas (8.6 per cent) and medical spas (8.3 per cent) – this is largely unchanged on 2015.

Demand for talent

Compensation remains a hot topic in the US spa industry. The number of unfilled vacancies still stands out, with more than three in five (61 per cent) spas reporting service-provider vacancies. The number of service provider vacancies in 2016 is estimated at 32,390, a 13 per cent fall on the previous year’s figure, and perhaps a sign of progress in a key area for the industry’s future growth. Nevertheless, the number of unfilled director and manager vacancies has remained static at 1,230 – the majority of these being vacancies for spa managers (1,030). This year’s analysis shows, therefore, that as the industry’s growth continues, so does the demand for talent across all job roles.

Looking ahead

With the industry striving for further expansion, many spas reported actively taking steps to keep up with emerging trends and ensure future growth.

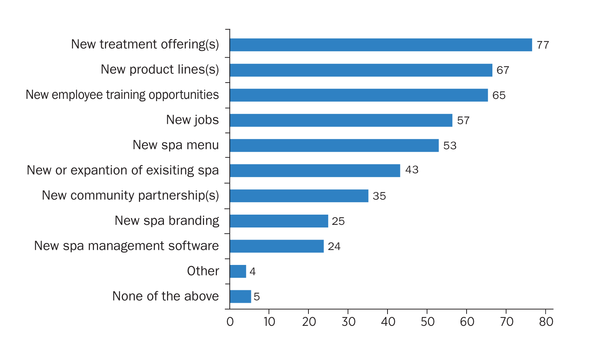

Technology is unsurprisingly at the forefront, and more than four in five spas (83 per cent) said they offered social media promotions in 2016, with over three in five (62 per cent) offering online booking options. Looking to the future, the vast majority said they plan to add or create a range of enhancements to their business (95 per cent), with over three quarters (77 per cent) intending to add new treatment offerings and two thirds (67 per cent) planning to introduce new product lines.

Similarly, from a personnel perspective, almost two in three spas (65 per cent) said they plan to add or create new employee training opportunities, and over half (57 per cent) plan to create new job opportunities. Respondents were also asked what they believe will be the next big thing to shape the industry. Wellness, health and fitness remains the most frequently cited trend, mentioned by almost one in three spas (32 per cent). Some distance behind, the second-most-popular choice was the use of organic/natural products (12 per cent), often linked to themes around sustainability and local sourcing.

Table 1:

The Big Five Statistics: Out-turn and percentage change in 2016

Graph 1:

Planning to add or create in 2017

Research findings in detail

ISPA is a professional organisation, representing providers in more than 70 countries and encompassing all aspects of the spa experience, from facilities through to instructors, professional practitioners and product suppliers. Its role is to advance the industry by providing educational and networking opportunities, promoting spas and fostering professionalism and growth. To gain more in-depth industry understanding, ISPA commissioned the first US Study in 2000, followed by updates in 2002, 2004, 2006, 2007, and every year from 2010 onwards. Shorter tracking studies documented performance in 2003, 2005, 2008 and 2009.

Topics covered in detail in the full ISPA 2017 US Spa Industry Study prepared by PwC include:

• Overall industry size and growth.

• Industry profile – size and type of spa by geography and year of start-up.

• Services, facilities and products offered across the spectrum of spa types.

• Compensation - differences by type of spa, type of employment and role.

The full report, with technical appendix, is available at experienceispa.com. ISPA members may download a complimentary copy of the ISPA 2017 US Spa Industry Study and non-members may purchase the report through this site.

The 2017 U.S Spa Industry Study was released at ISPA’s 2017 conference, which took place 16-18 October 2017 in Las Vegas.

About the author:

Colin McIlheney is the global research director at PricewaterhouseCoopers, and in his 33-year career, he’s designed more than 200 international surveys. He’s also the research advisor for ISPA, and was the lead manager on the 2017 US Spa Industry Study.

email: [email protected]

Tel: +1 888 651 4772