features

IHRSA update: World of fitness

IHRSA’s Kristen Walsh analyses the key findings from the 2017 IHRSA Global Report

The private sector of the global health club industry is on a high, with continued growth in 2016, according to the 2017 IHRSA Global Report, which was published in May.

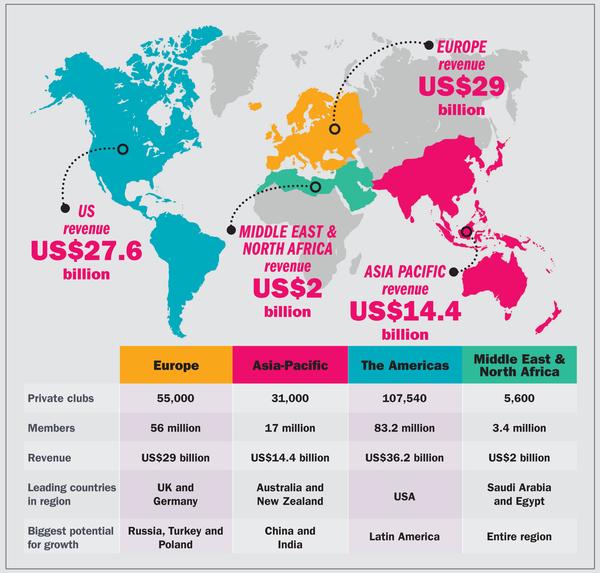

Total industry revenue reached an estimated US$83.1 billion, as roughly 200,000 clubs served 162 million members worldwide. The markets in North America and Europe continued to grow, while markets in Latin America also posted strong performances (See HCM June 2017, page 70).

The outlook of the private health club industry is promising and the sector is expected to thrive in the global marketplace, serving consumers with a variety of health and fitness needs.

With access to fitness amenities, instructors, personal trainers and coaches, club operators are well-positioned to lead a healthier world.

Europe

In spite of a weakening Euro and challenges in the political landscape, the fitness industry in Europe continued its robust performance. The European health club market serves more than 56 million members, with nearly 55,000 health and fitness clubs generating US$29 billion in revenue. The UK and Germany continue to lead all markets in Europe.

In the UK, based on research by LeisureDB, 9.7 million people belong to a private corporate health club, up from 9.3 million a year ago. Approximately 6,728 facilities in the UK generate a collective US$6.1 billion in industry revenue. Germany attracts more than 10 million members to 8,600 facilities and generates US$5.6 billion in revenue.

According to the European Health & Fitness Market Report, Europe has strong prospects for growth, not only in the mature markets of Western Europe, but also in Eastern European markets such as Russia, Turkey and Poland. The penetration rates in these three markets are among the lowest in Europe, signifying good potential for growth.

Asia-Pacific

The health club industry in the Asia-Pacific region served 17 million members at 31,000 health clubs across 14 markets in 2016 (excluding the Middle East). Health club industry revenue totals US$14.4 billion in this region.

The IHRSA Asia-Pacific Health Club Report shows there is room for growth in the region, as the average member penetration rate is just 3.8 per cent. Australia and New Zealand lead all Asia-Pacific markets in penetration rate at 14.8 per cent and 11.4 per cent, respectively.

Cities in Asia, including Beijing, Shanghai, Kuala Lumpur and Jakarta, are home to maturing industries, while future growth is anticipated in other expanding cities, as well as the Asia-Pacific region overall.

Opportunities for the fitness industry abound in the global economic powerhouses of China and India, which had penetration rates of 0.4 per cent and 0.12 per cent, respectively. China is home to roughly 2,700 health clubs with a total of 3.9 million members in 2016. The health club industry in India has roughly 3,800 health club facilities and nearly one million members.

Canada

The IHRSA Canadian Health Club Report indicates that club operators serve nearly 6 million members at roughly 6,000 facilities in Canada. IBISWorld – an independent industry research firm – says revenue Canada will increase through 2019.

Consumer demand for health and fitness programmes to help address obesity, active ageing, proper nutrition and sports performance will help drive industry growth.

The US

In the United States, levels of health club revenue, membership and the total number of clubs all rose between 2015 and 2016.

Revenue increased from US$25.8 billion in 2015 to US$27.6 billion in 2016, while membership improved from 55.1 million to 57.2 million over the same period.

The US private sector club count grew slightly, from 36,180 locations to 36,540 in the same time period according to IHRSA.

Middle East & North Africa

Based on findings gathered by The FACTS Academy – industry experts based in Egypt – approximately 3.4 million members utilise 5,600 private health clubs in 10 markets in the Middle East and North Africa (MENA). These 10 markets collectively generate roughly US$2 billion in industry revenue. Saudi Arabia leads all markets in this region in revenue with nearly US$620 million generated at 1,100 health clubs, which attract more than 800,000 members. In terms of club count and memberships, Egypt leads all MENA markets with 1,680 facilities and 957,500 members.

Despite conflicts in several MENA countries, there is a demand for fitness as consumers seek to exercise and reap the benefits of an active lifestyle. Successful international fitness operators, including Fitness First, Gold’s Gym and World’s Gym, have expanded into the Middle East.

In less than 10 years, Fitness Time, based in Saudi Arabia, grew to 100 club locations, highlighting the opportunities in this region.

Latin America

Leading markets continue to perform well in Latin America. Based on data gathered in the recently updated IHRSA Latin American Report (Second Edition), Brazil is second only to the US among global fitness markets, with 34,509 health clubs. More than 9 million Brazilians are members of a health club. In all, 18 markets in Latin America attract nearly 20 million consumers to more than 65,000 health clubs.

Opportunities for growth still exist in Latin America, as member penetration rates remain low in comparison with developed health club markets worldwide.

HEADLINE NUMBERS - IHRSA 2017 GLOBAL REPORT

Find out more

To access any of the reports cited in this article, visit: www.ihrsa.org/research-reports

About IHRSA

Founded in 1981, IHRSA – the International Health, Racquet & Sportsclub Association – is the only global trade association, representing more than 10,000 health and fitness facilities and suppliers worldwide. Locate an IHRSA club at www.healthclubs.com

To learn how IHRSA can help your business thrive, visit www.ihrsa.org